Annual engagement surveys are fine. They’re also slow. By the time you see a problem in the data, it’s already a real issue on the floor. That’s why employee pulse surveys work. They’re short, frequent check-ins that tell you what’s changing right now, not what changed six months ago.

But a pulse survey only helps if people trust it, and if you actually do something with the feedback.

This guide shows you how to run pulse surveys that get honest answers, spot problems early, and turn results into action quickly.

You’ll learn how to:

- Choose the right cadence (weekly, monthly, quarterly)

- Ask questions that get honest answers (without bias)

- Turn results into action within 14 days

- Use ready-to-launch templates and a setup checklist so you can move fast

If you want pulse surveys that actually improve retention, performance, and manager effectiveness, you’re in the right place.

Let’s start with what a pulse survey is (and what it is not).

What Is An Employee Pulse Survey (And What It Is Not)

An employee pulse survey is a short survey you run on a regular schedule to track how your team is doing.

Usually, it is 5 to 10 questions. It takes under 2 minutes to complete. And it focuses on one or two themes at a time (not everything at once).

The goal is simple: get real feedback while you still have time to act on it.

What A Pulse Survey Is

A pulse survey helps you measure things like:

- Engagement and morale

- Workload and burnout

- Manager effectiveness

- Team communication

- Change readiness (during big shifts like restructuring or policy updates)

- Early signs of retention risk

You use it to spot patterns, not to chase individual complaints.

What A Pulse Survey Is Not

Most pulse surveys fail because people treat them like something else.

A pulse survey is not:

- A long annual engagement survey broken into smaller parts

- A “random check-in” you send only when something feels off

- A way to collect feedback and leave it sitting in a spreadsheet

- A tool to confirm what leadership already wants to hear

If your pulse survey is long, unpredictable, or never leads to action, it will stop working fast.

A Quick Example

Here’s a simple pulse survey that works in almost any team:

- How would you rate your workload this week? (Light, manageable, heavy, unsustainable)

- Do you have what you need to do your job well? (Yes, mostly, not really, no)

- How supported do you feel by your manager right now? (1 to 5 scale)

- What is one thing slowing you down? (short answer)

That’s it. You are not trying to measure everything. You are trying to find out what is shifting.

Types of Pulse Surveys & How to Use Them

Pulse surveys work best when you use them for one job at a time.

If you try to measure everything in one survey, you’ll get vague feedback and low-quality data. Keep each pulse focused, then rotate topics.

Most teams mess up pulse surveys in one of two ways:

- They run the same generic engagement survey every month.

- Or they ask everything at once and wonder why nobody finishes it.

Instead, pick the pulse survey type based on what you want to solve.

| Pulse Survey Type | Use It When You Want To… | Best Cadence | Best For |

|---|---|---|---|

| eNPS pulse | Track loyalty and overall sentiment over time | Quarterly | Leadership and HR |

| Engagement and morale pulse | Spot early disengagement and morale dips | Monthly | Most teams |

| Workload and burnout pulse | Catch overload before it becomes churn | Weekly or biweekly | Support, sales, ops |

| Manager effectiveness pulse | Identify manager gaps and coaching needs | Monthly or quarterly | Growing orgs |

| Change readiness pulse | See how a change is landing in real time | Weekly | Restructuring, RTO, rollouts |

| Internal department feedback | Measure how HR/IT/support is serving teams | Monthly or quarterly | Shared services |

| Frontline employee pulse | Collect feedback from workers without email | Monthly or biweekly | Retail, logistics, manufacturing |

1. eNPS & Engagement

Use this when you want to track whether people still feel good about work, the team, and leadership.

Best for:

- General engagement tracking

- Company culture pulse checks

- eNPS surveys

Measure:

- Motivation and energy

- Pride in the company

- Whether work feels meaningful

- Likelihood to recommend the company (eNPS)

Good cadence:

- Monthly for engagement

- Quarterly for eNPS

Ask:

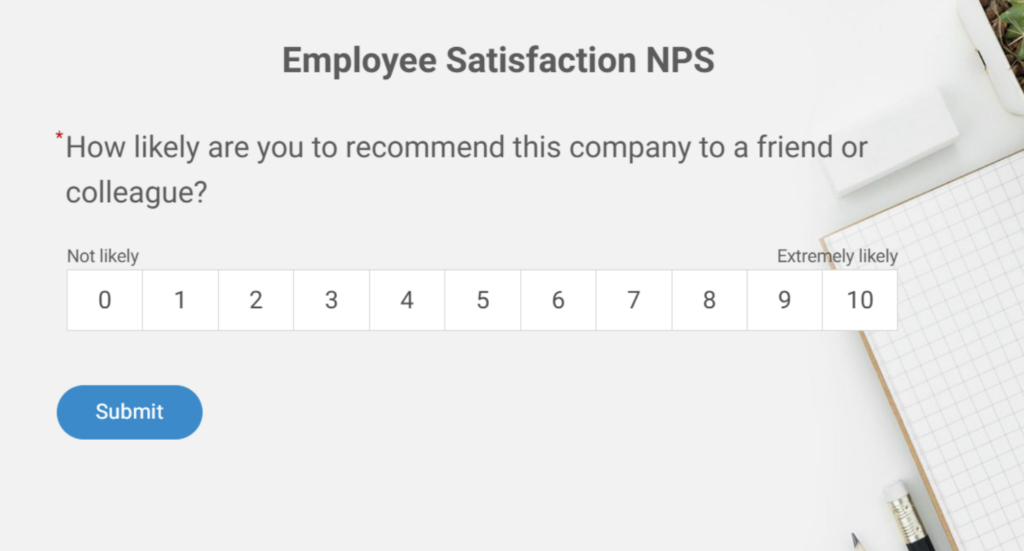

- How likely are you to recommend this company as a place to work? (0 to 10)

- What is the main reason for your score? (Short answer)

Here’s a quick eNPS template for you:

2. Workload & Burnout Risk

Use this when you want to catch stress spikes early, especially in fast-moving teams.

Best for:

- Support, sales, operations

- High-growth or peak season workloads

- Teams with increasing churn risk

Measure:

- Workload sustainability

- Stress levels

- Ability to disconnect

- Whether priorities feel clear

Good cadence:

- Weekly during high-pressure periods

- Biweekly or monthly otherwise

Ask:

- How manageable is your workload right now? (Manageable to unsustainable)

- Do you feel you can disconnect after work? (Yes, sometimes, rarely, no)

- What is slowing you down most? (Short answer)

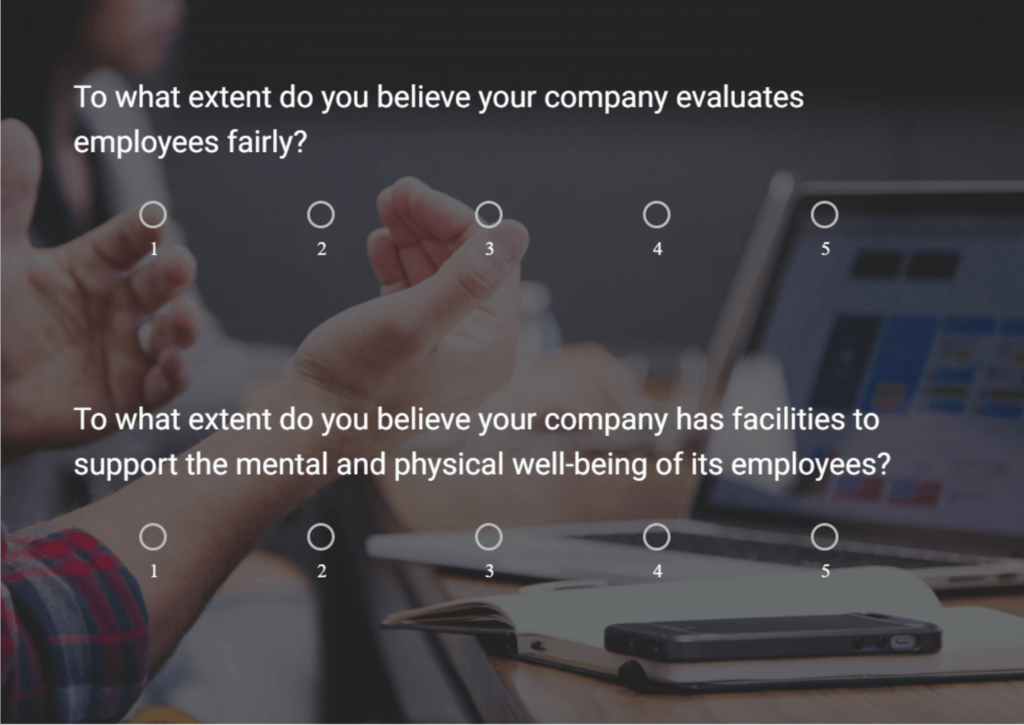

Here’s a quick burnout and workplace wellbeing template for you to tweak and use:

3. Manager Effectiveness

Use this when manager quality varies across teams, or when you want to stop attrition caused by bad leadership.

Best for:

- Fast-growing companies adding new managers

- Teams with low morale

- Leadership development programs

Measure:

- Clarity of expectations

- Quality of feedback

- Support and trust

- Whether issues get resolved quickly

Good cadence:

- Monthly

- Quarterly if things are stable

Ask:

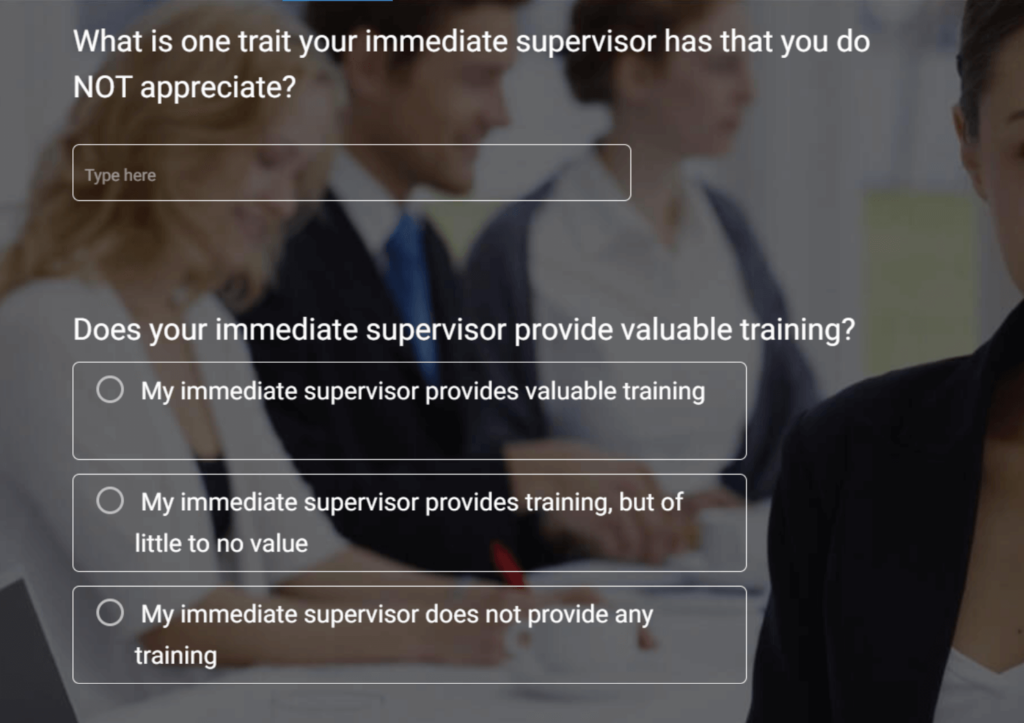

- My manager sets clear expectations. (Agree scale)

- I get useful feedback that helps me improve. (Agree scale)

- What is one thing your manager should do differently? (Short answer)

This one only works if you’re willing to coach managers based on results. If not, skip it. You can tweak and use this quick manager satisfaction survey template:

4. Team Communication & Collaboration

Use this when you suspect silos, unclear ownership, or constant coordination breakdowns.

Best for:

- Cross-functional teams

- Product and engineering groups

- Remote or hybrid teams

Measure:

- Communication clarity

- Speed of decision-making

- Meeting usefulness

- Psychological safety to speak up

Good cadence:

- Monthly

- Biweekly during re-orgs or major hiring phases

Ask:

- I understand what is changing and why. (Agree scale)

- I feel supported through this change. (Agree scale)

- What is unclear or frustrating right now? (Short answer)

Here’s a communication and collaboration pulse template for you:

5. Change Readiness (And Change Fallout)

Use this whenever you roll out something that will trigger strong opinions.

Best for:

- Restructuring

- Return-to-office policies

- New systems or tools

- Leadership transitions

Measure:

- Understanding of the change

- Confidence in leadership

- Support during transition

- Friction and confusion points

Good cadence:

- Weekly for 4 to 6 weeks after launch

- Biweekly after that if needed

For this you can use a pulse microsurvey that gauges employee emotions in the moment, on channels like Slack or any communication platform you use. Here’s a quick video to create an in-context microsurvey:

6. Internal Department Service Feedback

Use this when you want to measure how well internal teams serve the rest of your org.

Best for:

- HR, IT, finance, facilities, support

- Internal ticketing and service processes

Measure:

- Speed of resolution

- Quality of help

- Ease of getting support

- Overall satisfaction

Good cadence:

- Monthly or quarterly

- After major initiatives or rollouts

Ask:

- How satisfied are you with the support you received? (1 to 5)

- Was your issue resolved fully? (Yes/no)

- What should we improve? (Short answer)

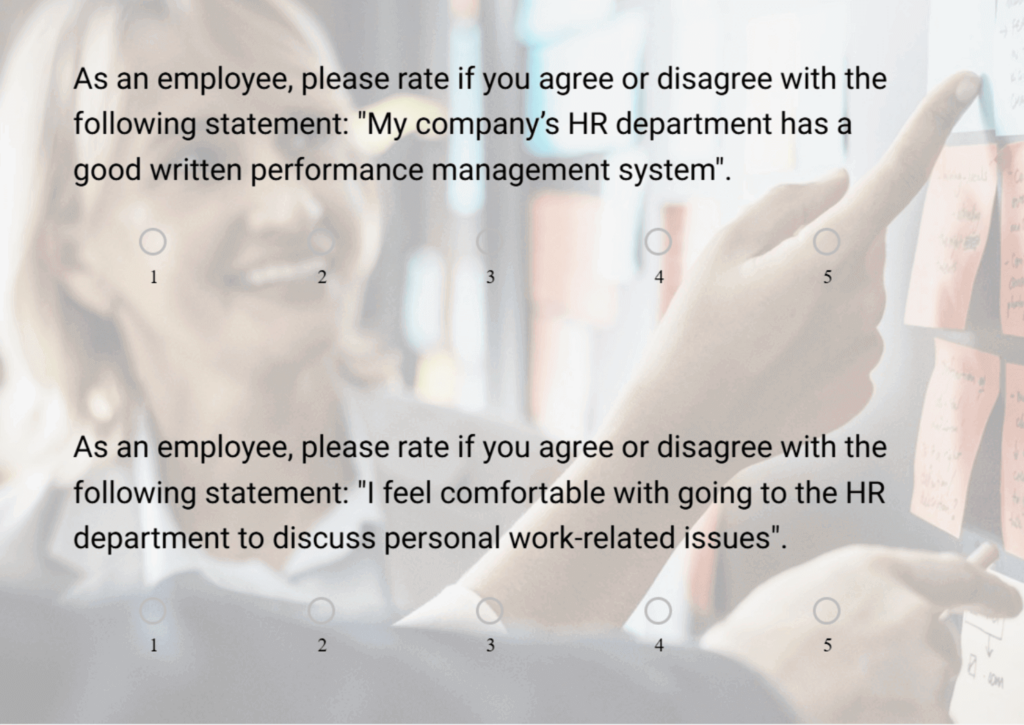

Here’s a quick HR pulse survey template you can customize and use:

7. Frontline Employee Pulse Survey

Use this when employees do not have email or regular computer access.

Ask:

- How was your week at work? (Good, okay, bad)

- Do you have what you need to do your job safely? (Yes/no)

- What is one thing that would make your job easier? (Short answer)

This works best on shared tablets or kiosks with a short link or QR code. If it takes more than a minute, participation drops.

3. Start With These Three If You’re Unsure

If you don’t know where to start, start here:

- Engagement and morale

- Workload and burnout

- Manager effectiveness

These three cover most problems early, and they give you clear action paths.

4. Use This Simple Cadence Rule

Pick your cadence based on how quickly you can close the loop:

- Weekly, if you can review results and take action within 7 days.

- Biweekly, if you can act within 2 weeks.

- Monthly, if you can act within 30 days.

- Quarterly, if you want benchmarks and long-term trends (like eNPS).

If you don’t know what cadence to pick, start monthly. It is the safest default.

How To Set Up An Employee Pulse Survey Program (Step By Step)

Most pulse surveys don’t fail because the tool is bad. They fail because the setup is lazy.

If you want honest answers and repeat participation, you need three things in place before you send anything:

- A clear purpose

- A believable anonymity plan

- A plan for what happens after the results come in

Here’s the setup process that actually works.

Step 1: Decide The One Thing You Want To Learn

Pick one theme per survey cycle.

Good Themes:

- Workload and burnout

- Manager support

- Engagement and morale

- Change readiness

Bad Theme:

- “Employee satisfaction” (too broad, too vague)

If you can’t explain what you’ll do if the score is low, don’t ask the question.

Step 2: Choose Who Gets The Survey (And Who Does Not)

This is where most teams mess up.

If you send one pulse survey to everyone, you’ll get average data that helps nobody.

Instead, decide whether this survey is:

- Company-wide (suitable for engagement pulses and eNPS)

- Team-specific (suitable for workload, manager feedback, department service)

- Role-specific (suitable for frontline teams, support teams, sales teams)

Keep it targeted when possible. That’s how you get actionable feedback.

Step 3: Choose The Right Tool (Or Your Pulse Program Will Collapse)

A pulse survey program is not “send a Google Form and export a spreadsheet.”

You need a tool that makes it easy to run surveys on a schedule, analyze results quickly, and protect anonymity. Otherwise you’ll burn time on admin work and employees will lose trust.

Here’s what to look for.

What You Need In A Pulse Survey Tool:

- Fast setup: You should be able to launch in minutes, not days.

- Recurring surveys: So you’re not rebuilding the same survey every time.

- Anonymous responses: With privacy settings you can actually enforce.

- Dashboards and trend tracking: So you can spot changes over time, not just read one-off results.

- Segmentation with guardrails: You want breakdowns by team or location, but only when groups are large enough to protect privacy.

- Multiple distribution options: Email, link, QR code, kiosk mode, mobile-friendly.

- Export and sharing: For leaders who want reports without logging into the tool.

If you want a tool that is quick to deploy and easy to run at scale, ProProfs Survey Maker works well for pulse surveys because you can:

- Use ready-made employee survey templates

- Launch anonymous pulse surveys quickly

- Share via email, link, or QR code (useful for frontline teams)

- Track responses with dashboards and reports

- Share reports with stakeholders without messy spreadsheets

Here’s a quick video to learn more about anonymous surveys:

This is the tool you use when your goal is: collect feedback consistently, analyze it fast, and act.

Step 3: Keep It Short (And Build The Survey Properly)

Use This Structure:

- 3 to 5 rating-scale questions

- 1 open-text question

- Total time: under 2 minutes

Avoid:

- 15-question “quick surveys”

- Two open-text questions

- Questions that bundle multiple topics into one

If you want reliable data, your questions need to be simple enough that nobody has to “think hard” to answer. Here’s how to create effective employee surveys:

Step 4: Make Anonymity Believable (Not Just Promised)

Most employees assume pulse surveys are not anonymous.

So don’t just say “this is anonymous.” Make it hard to identify people.

Use these rules:

- Don’t show results for teams smaller than 5 to 10 people.

- Don’t allow slicing by too many demographics at once.

- Be careful with open text. It’s the easiest way to identify someone.

- Do not let managers see individual-level responses.

If you want authentication (to prevent duplicate submissions), use employee ID or PIN, but keep responses anonymous.

Step 5: Pick A Distribution Method That Fits Your Workforce

This matters more than people think.

Choose the Distribution Channels Based on How Your Employees Work:

- Desk teams: Email or Slack link

- Frontline teams: QR code, short URL, kiosk mode on a shared tablet

- Distributed workforce: Mobile-friendly link plus short reminder

If a big chunk of your workforce does not have email access, do not pretend email distribution will work. It won’t.

Step 6: Send A Launch Message That Builds Trust

Keep it short. Don’t oversell it.

Here’s a script you can copy:

Subject: Quick pulse survey (2 minutes)

Message:

Hey team, we’re running a short pulse survey to understand how things are going right now. It takes less than 2 minutes.

This survey is anonymous. We will share what we learn and what we’re going to change based on the results.

Here’s the link: [link]

Thank you.

That’s enough. The more you explain, the more people get suspicious.

Step 7: Decide What Happens After The Survey Closes

This is the step that separates real programs from “tick-the-box” surveys.

Before You Launch, Decide:

- Who reviews results (name the owner)

- When results are reviewed (within 48 to 72 hours)

- When results are shared (within 7 days)

- When actions are announced (within 14 days)

If you don’t set this upfront, the survey will become a black hole.

A Simple Setup Checklist (Use This Every Time)

Before you launch, make sure:

- You picked one theme.

- You targeted the right group.

- The survey takes under 2 minutes.

- Anonymity rules are clear.

- The distribution method fits the workforce.

- The launch message is written.

- Owners and timelines are assigned.

If you do just this much, your pulse survey program will already be better than most. If you also want to improve engagement through continuous learning and development, that’s where the ProProfs Smarter Employee Learning Suite fits.

How To Analyze Employee Pulse Survey Results (And Know What To Do Next)

Collecting responses is the easy part. The value comes from what you do in the next 48 hours.

If you only stare at averages, you’ll miss the real story.

Here’s how to analyze pulse survey results like an operator.

1. Start With This 10-Minute Review

Before you segment, filter, or overthink anything, look at these three things first:

- Response Rate: If it is low, your results are biased.

- Big Swings: Any score shift that drops suddenly is usually real.

- Comment Themes: The open-text question is where the truth lives.

If you don’t do anything else, do this.

2. Check Response Quality (Not Just Response Count)

A “high response rate” can still produce bad data.

Watch for these signs:

- Everyone answers neutral (fear or apathy).

- Comments are vague (“all good”, “nothing to add”).

- Participation drops every cycle.

If you see this, your biggest issue is usually trust or the action gap, not survey design.

3. Look For Trends, Not One-Off Scores

Pulse surveys are meant to show movement.

So instead of asking: “What is the score this month?”

Ask: “What changed since last month?”

Look for:

- A steady decline over 2 to 3 pulses

- Spikes after a change rollout

- A department that is consistently below baseline

Those are the signals you act on.

4. Segment Carefully (So You Don’t Break Anonymity)

Segmentation is useful, but it can destroy trust fast.

Segment only when:

- The group size is large enough (at least 5 to 10 people)

- You’re looking for patterns, not suspects

- You’re ready to act on what you find

Safe ways to segment:

- By department (large groups)

- By location (large groups)

- By role type (frontline vs desk)

Avoid slicing by too many filters at once. That’s how people get identified.

5. Turn Open-Text Comments Into Themes

Do not read comments one-by-one and get emotional. That’s how leaders spiral.

Instead, do this:

- Skim all comments once.

- Group them into 3 to 5 themes.

- Count how often each theme shows up.

- Pull 2 to 3 representative examples for each theme.

Your output should look like this:

- Theme: “Workload is unsustainable” (mentioned 18 times)

- Theme: “Manager communication is unclear” (mentioned 11 times)

- Theme: “Tools/processes slow us down” (mentioned 9 times)

That becomes your action plan.

6. Translate Results Into Actions (The Only Part That Matters)

An employee pulse survey result is useful only if it leads to a decision.

Use this simple action mapping:

| What You See | What It Usually Means | What You Do Next |

|---|---|---|

| Workload Scores Drop | Capacity or prioritization issue | Cut scope, rebalance work, hire, remove busywork |

| Manager Scores Drop | Coaching and clarity issue | Manager training, 1:1 quality review, leadership support |

| Engagement Drops Slowly | Trust or recognition gap | Improve clarity, recognition, growth conversations |

| Comments Mention “Nothing Changes” | Action gap | Announce 2 quick wins fast, then commit to timeline |

| Everyone Answers Neutral | Fear or low trust | Reinforce anonymity, reduce slicing, change how results are shared |

If you can’t name the action, you didn’t learn anything.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

How To Respond To Negative Feedback (Without Making Things Worse)

Negative feedback is not the problem. What you do next is.

If you ignore it, debate it, or try to guess who wrote it, your next employee pulse survey will be useless. People will stop being honest, and you’ll get safe, neutral answers.

Respond fast and keep it simple. Acknowledge what you heard, share what you’re doing next, give a timeline, and close the loop. You don’t need a long speech. You need follow-through.

Use this message:

| “Thanks for the feedback. Some of it was hard to read, and that’s exactly why it matters. Here’s what we heard, what we’re going to do, and when you’ll hear from us next.” |

If feedback targets managers, don’t forward raw comments or turn it into a blame game. Look for patterns across multiple pulses, then handle them through coaching and support.

If employees say “nothing ever changes,” treat it like a red flag. Deliver one quick win within 14 days, share one bigger action with an owner and a deadline, and be honest about what you can’t fix right now.

Finally, close the loop every cycle with a short “You said, we did” update. That’s how you build trust and maintain high response rates.

Start Your First Pulse Survey This Week

Employee pulse surveys work when you treat them like a system, not a one-time survey.

Keep them short. Run them on a cadence you can sustain. Protect anonymity. And close the loop every cycle, even if the action is small.

If you want to launch fast without building everything manually, you can use ProProfs Survey Maker to create employee pulse survey from templates, share them via link or QR code, and track results with dashboards and reports.

And if you’re looking beyond surveys and want a broader approach to engagement through training and development, the ProProfs Smarter Employee Learning Suite helps you build continuous learning and support at scale.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

We'd love your feedback!

We'd love your feedback!

Thanks for your feedback!

Thanks for your feedback!