That’s why I still swear by email surveys—simple forms sent right after a key moment (a purchase, a support chat, a webinar). They’re old school, sure—but when done right, with smart timing, tight copy, and automation, email surveys can become your lowest-cost feedback engine.

They’ll tell you where your product breaks, what customers actually love, and how to fix churn before it happens.

This guide is built for founders, marketers, support leads, and product folks who want:

- Clarity on when and how to use email surveys

- Tips to stop getting ignored

- Real-world workflows, templates, and tools that actually work

When to Use Email Surveys—Moments That Actually Move the Needle

You don’t need to blanket-blast surveys every Friday. The wins come from event-driven sends, right when the experience is fresh and the emotion is real. Let’s look at some moments like these:

| Trigger Moment | Why It Nails the Timing |

|---|---|

| Right after a support ticket closes | People are already thinking about the help they got—perfect time for a two-question CSAT. |

| Immediately after purchase or renewal | They’re on a post-buy high (or a tiny bit nervous). A quick pulse captures both delight and doubt. |

| Webinar/course wrap-up | The content’s still top-of-mind, so feedback is specific and honest. |

| Onboarding day 7 (or first “aha” action) | Early friction shows up fast—catch it before it turns into churn. |

| Quarterly product check-in | Great for trendlines and big-picture sentiment, without spamming folks weekly. |

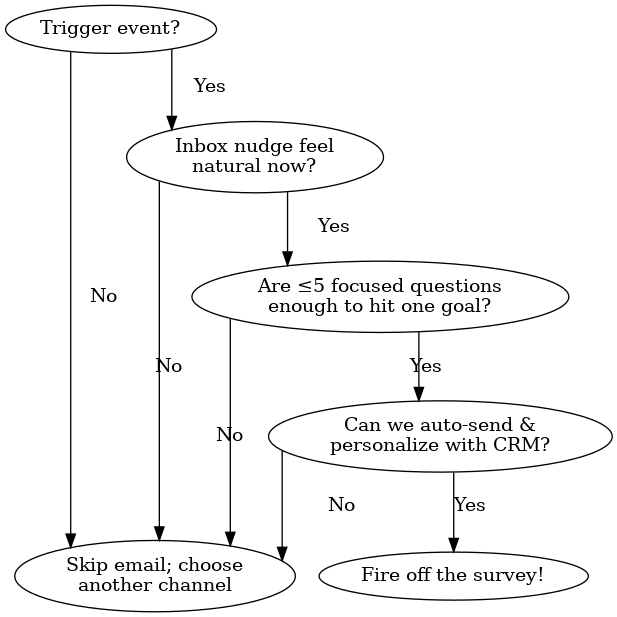

Here’s a quick Gut-Check Flowchart to decide if sending an email survey is going to be the right option or not:

Not only customer feedback, but email surveys are just as useful after an internal team meeting, a company event, a webinar, or a training session.

Not only customer feedback, but email surveys are just as useful after an internal team meeting, a company event, a webinar, or a training session.

The key is the same: send them right after the experience, while the feedback is still sharp.

| Trigger Moment | Why It Nails the Timing |

|---|---|

| Immediately after a training session or workshop | The material is still fresh—perfect time to capture confidence gaps or clarity issues. |

| Post-all-hands, offsite, or internal team event | People are still thinking about what was shared, which is great for gauging alignment and impact. |

| After the first week of employee onboarding | Early impressions are unfiltered, which is ideal for spotting onboarding friction while it’s actionable. |

| Following an exit interview or promotion process | Emotions and feedback are top-of-mind, great for uncovering blind spots or organizational issues. |

The 3 Types of Email Surveys (and When to Use)

If you’re just getting started, these are the five survey types I’d set up first. Each one serves a different purpose and plugs into a different moment in your customer journey. You don’t need all five on day one—just pick the one that fits your current stage, and layer the rest in as you grow.

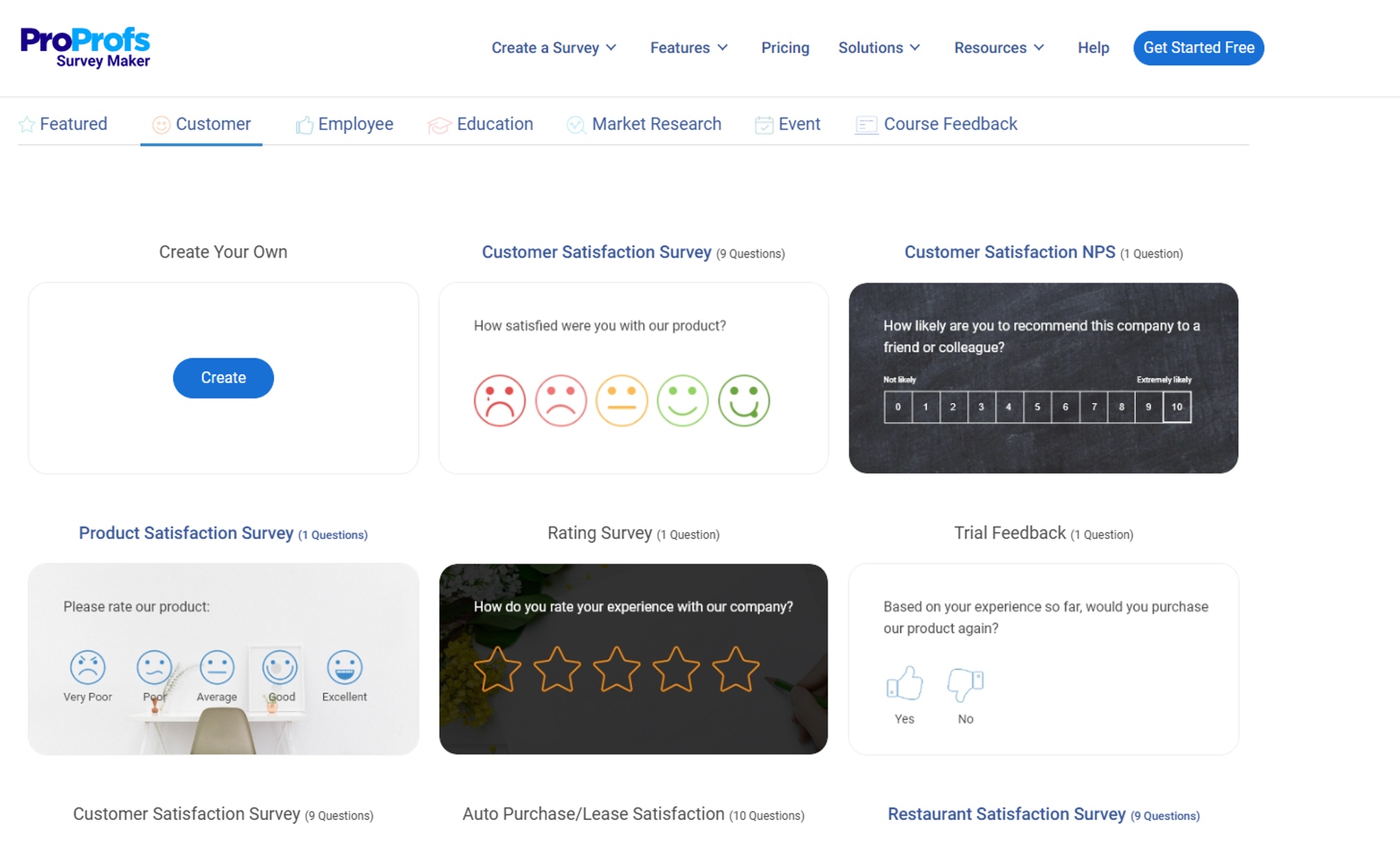

1. Customer-Facing Surveys

For capturing product experience, loyalty, and churn signals.

- Customer Satisfaction (CSAT): Ask immediately after a support interaction. “How satisfied were you with the help you received?”

- Net Promoter Score (NPS): Sent quarterly or after key milestones. “How likely are you to recommend us?”

- Post-Purchase Survey: Triggered 1–2 days after a transaction. “What influenced your buying decision?” or “How was the checkout process?”

- Feature Feedback: Sent a few days after a feature is used. “Was this feature easy to use?” “What could we improve?”

- Churn / Abandonment Survey: Ask when someone leaves or cancels. “What made you leave?” or “What would’ve changed your mind?”

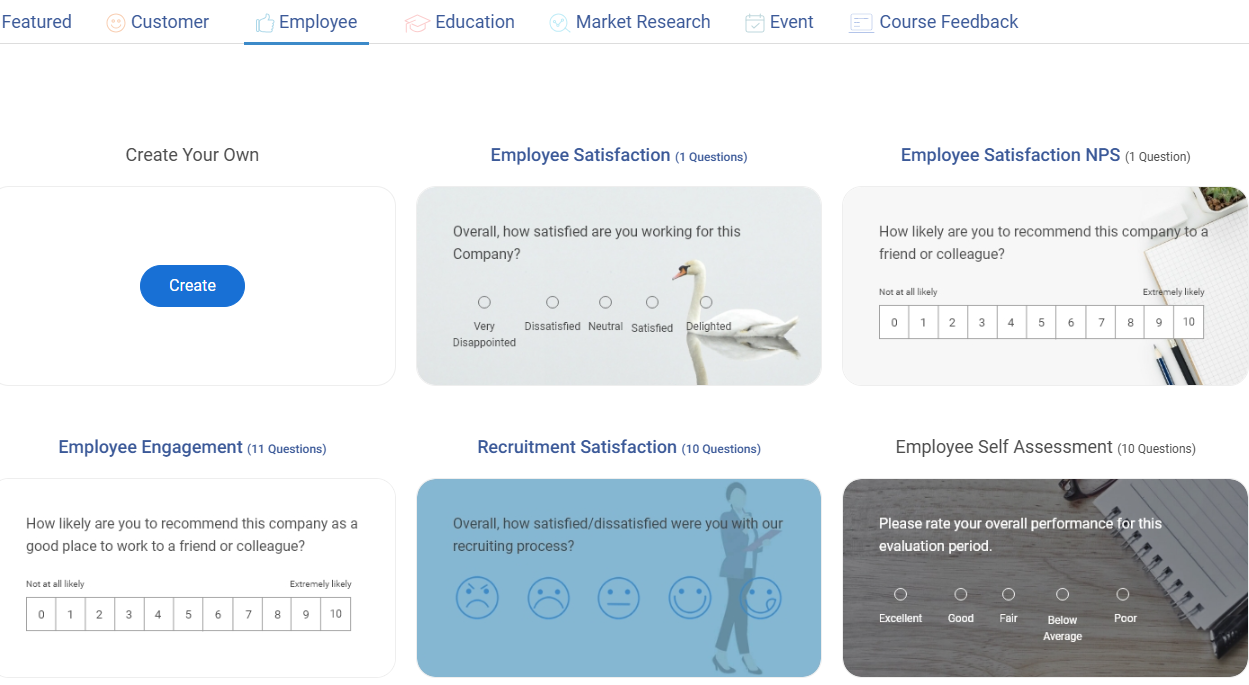

2. Human Resource Surveys – Employee Feedback

Used to improve team alignment, onboarding, and training.

- Employee eNPS or Pulse Surveys: Sent monthly or post-event. “How supported do you feel at work?” “Would you recommend working here?”

- Onboarding Feedback: Sent around Day 5 or Week 2. “Was anything unclear in your first week?”

- Training or All-Hands Feedback: Sent right after a workshop or team-wide event. “Did the session meet expectations?” “What would you change?”

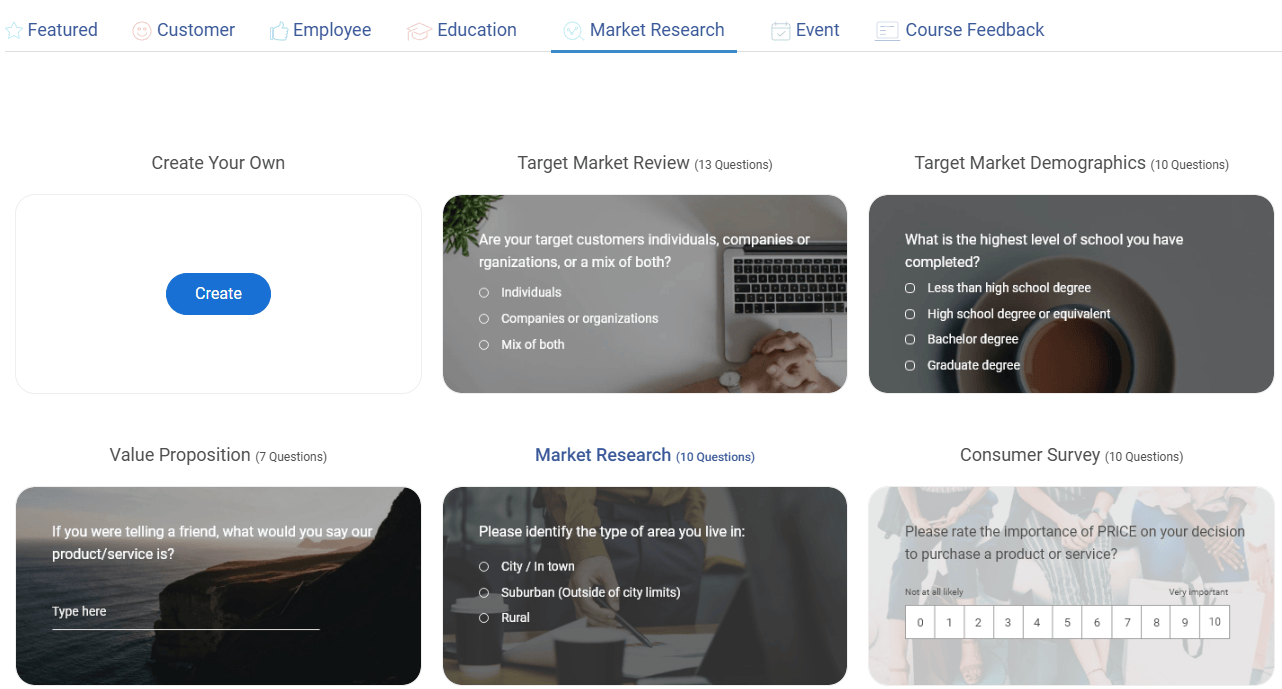

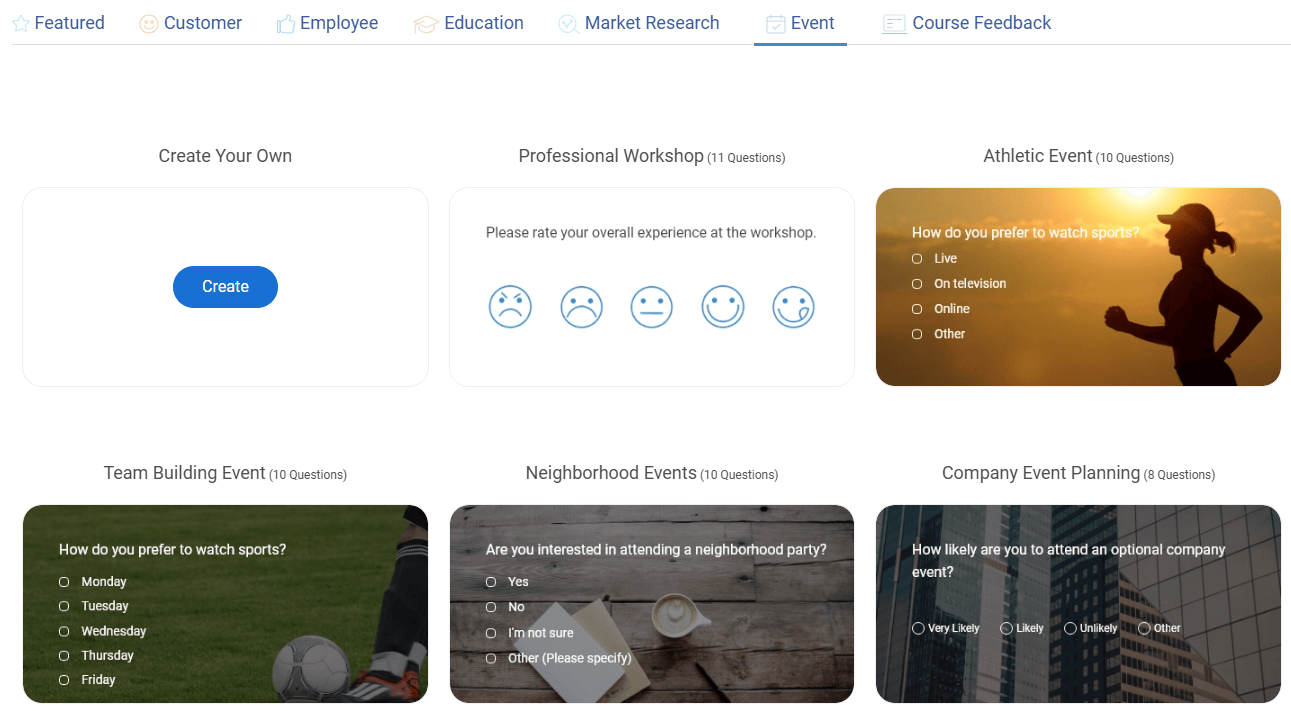

3. Industry-Specific & Research Surveys

- Market Research: Helps understand buyer preferences, decision-making, or brand awareness.

- Event & Trade Show Feedback: Sent post-event. “What did you enjoy most?” “Would you attend again?”

- Healthcare: Post-visit patient satisfaction surveys

- Restaurants: Post-dining or delivery feedback

- Auto-Purchase/Lease: After purchasing or leasing a property

- Banking & Insurance: Post-policy or customer service interactions

- Airline & Airport: Post-flight or airport facility feedback

My rule?

Send one email. Ask one or two smart questions. Give them an easy next step. That’s it. You’re not digging for gold—you’re just keeping the line open.

How to Create an Email Survey

I’ve tried a bunch of survey tools over the years—some were too clunky, some had great design but no automation, and a few just didn’t play well with my CRM.

Eventually, I landed on ProProfs Survey Maker, and here’s why it works:

- It’s quite simple to use—but powerful under the hood.

- It actually integrates with my existing tools (CRM, email, reporting—check).

- And the AI builder? It saves me so much time.

Let me show you how I use ProProfs AI to build email surveys quickly and without overthinking it.

Step 1: Start With a Survey (New or Existing)

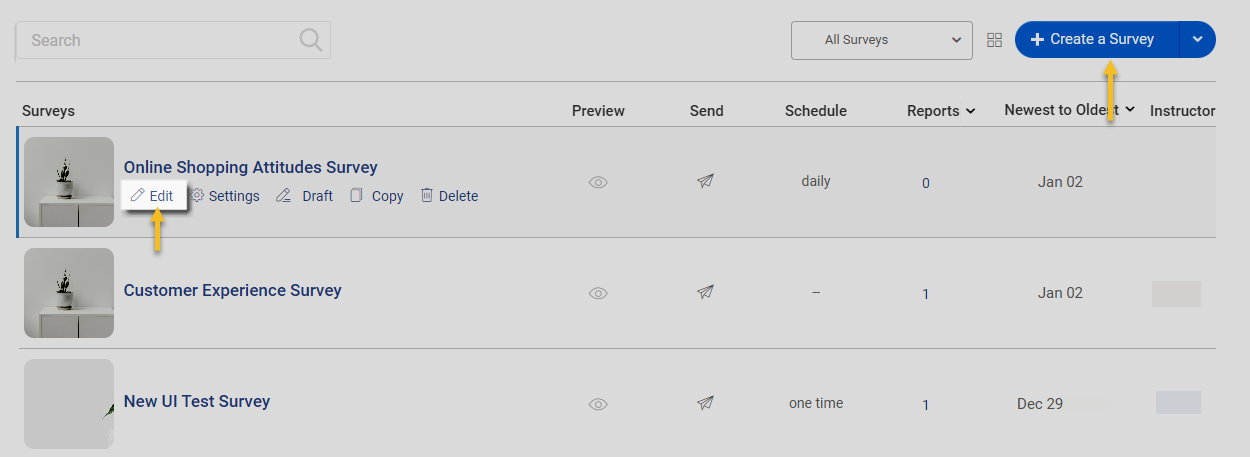

Head to your ProProfs dashboard and click Create a Survey. You can start from scratch or grab a template—but most of the time, I just edit an existing one I’ve already set up.

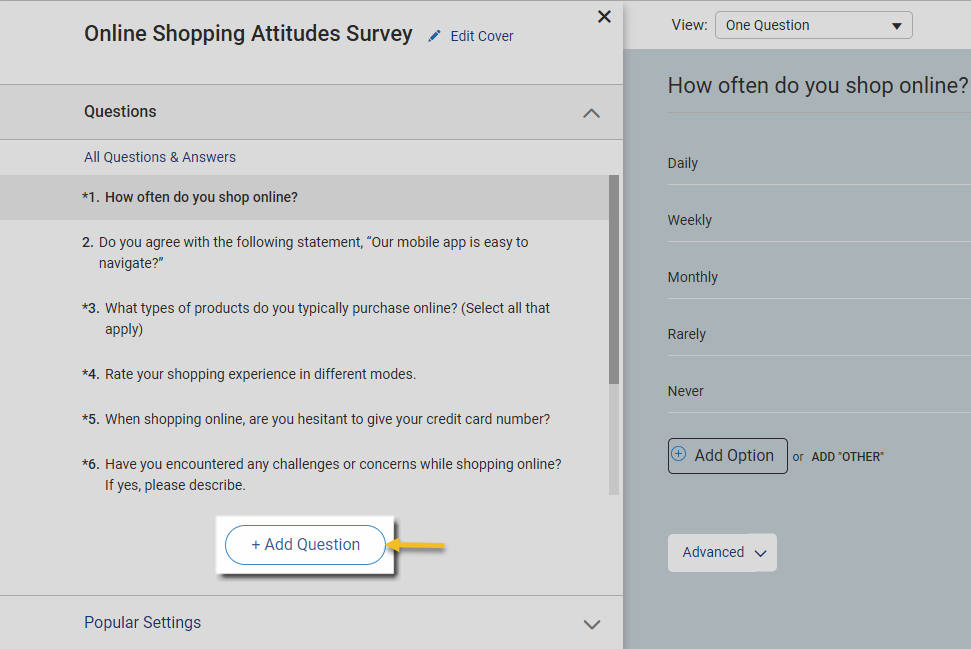

Step 2: Click “Add Question”

Pretty straightforward. Just tap Add Question inside the editor to drop in a new one.

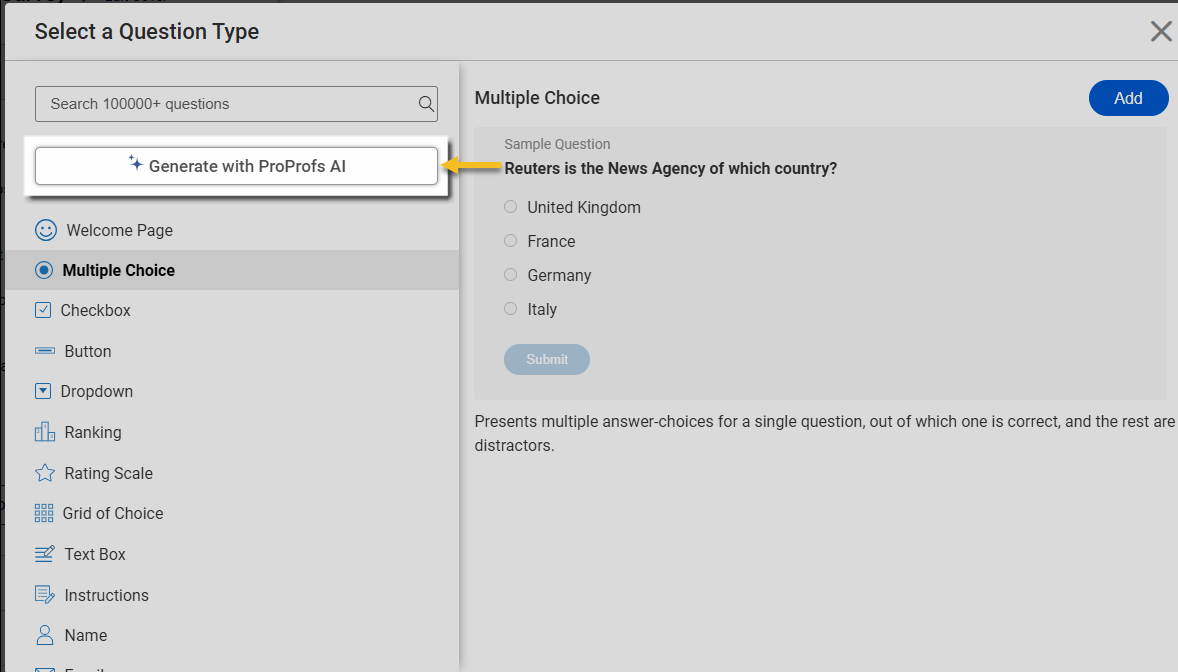

Step 3: Fire Up ProProfs AI

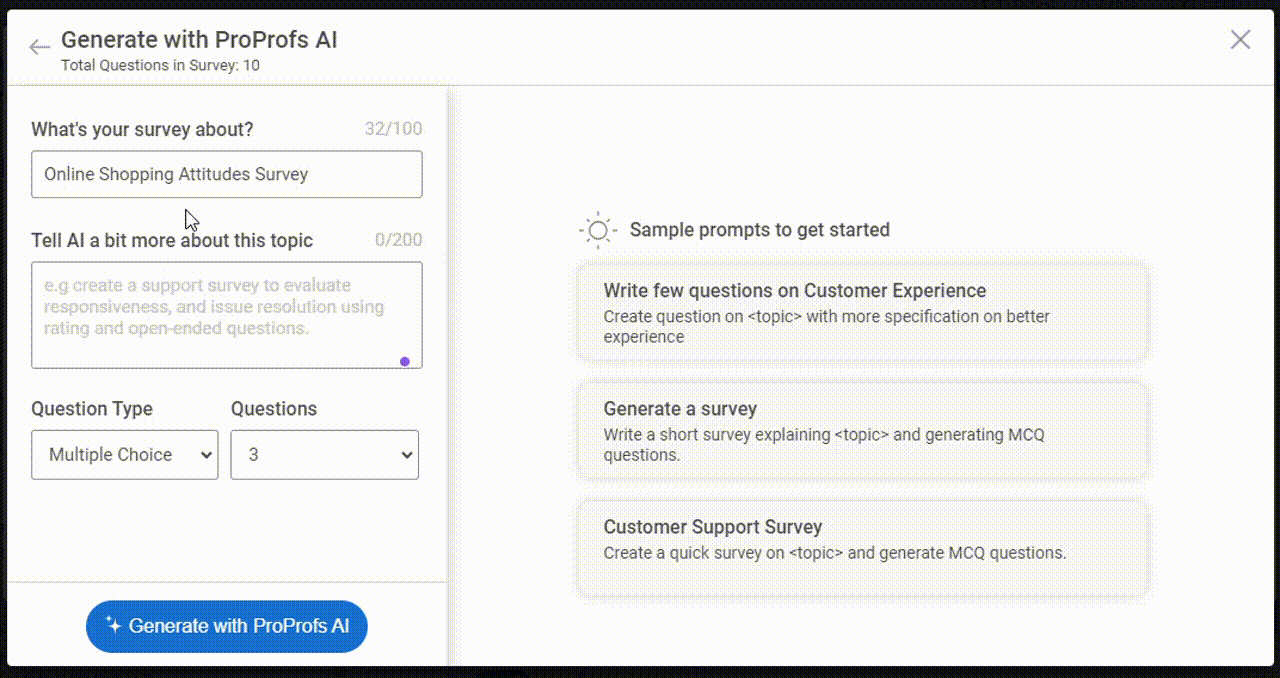

Now for the fun part. Click Generate with ProProfs AI, and it’ll open the smart question builder.

Step 4: Give the AI a Nudge

Tell it what you’re trying to learn. You’ll be prompted to:

- Add a short description of the survey

- Drop in a little context

- Choose the question type (e.g., rating, multiple choice)

- Select how many questions you want generated

Then hit Generate and let the AI do its thing.

#Bonus: Use these Sample Prompts to help you create the perfect surveys.

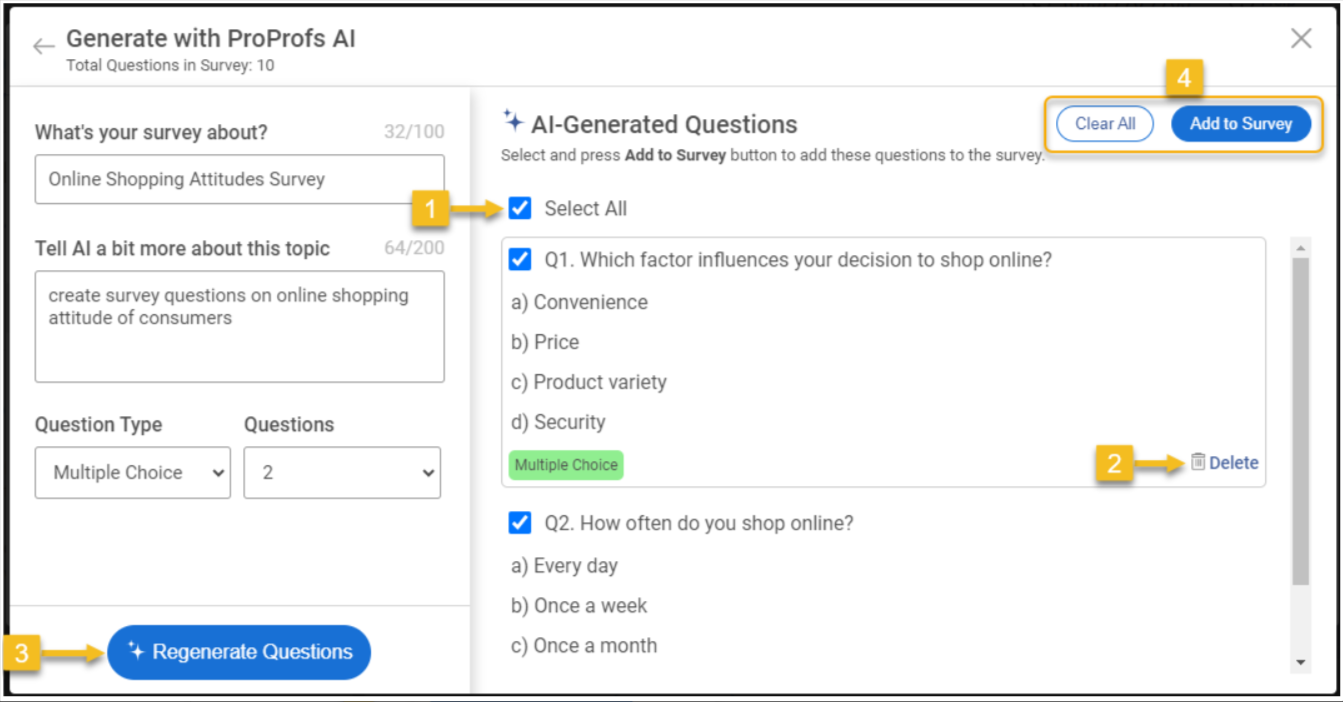

Step 5: Curate the Results

You’ll get a batch of smart, clean questions. From there:

- Add all, or hand-pick the ones you like

- Delete anything that doesn’t feel quite right

- Click Regenerate if you want a fresh take

- Use Clear All to wipe and restart

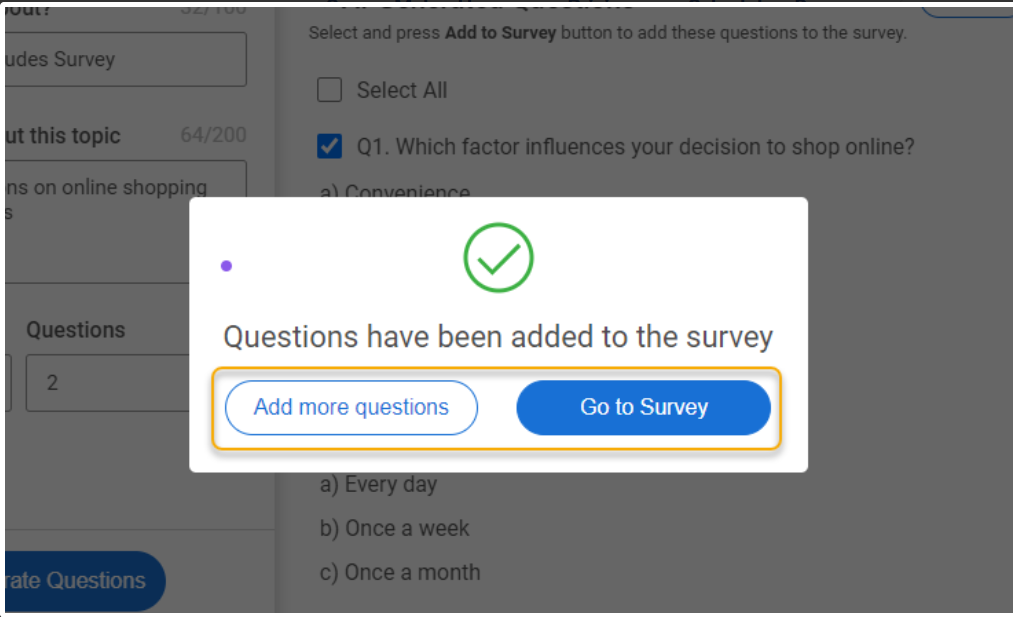

Step 6: Final Polish

Click Go to Survey to drop your chosen questions into the main editor. From there, you can:

- Refine wording

- Edit answer choices

- Adjust logic or branching

- Or just move on and launch

Why Email Surveys Still Work?

Email surveys might seem old-school, but they still deliver when used right. Here’s why they remain a powerful tool for feedback and retention:

1. You Can Target Exactly Who You Want

Email lets you get hyper-specific—

- “People who just renewed,”

- “Users who haven’t logged in for 7 days,” or

- “First-time buyers who used a discount.”

That means better context, better questions, and way better answers.

2. It’s Cost-Effective

There is no extra ad spend, SMS fees, or complex toolchains. You just need your existing email list and a survey tool that plugs in. This is great for lean teams or early-stage budgets.

3. It Plays Nice with Your Stack

Most survey tools hook right into your CRM, helpdesk, or marketing automation platform. That means you can trigger surveys automatically after events like purchases, support chats, or cancellations—no manual work needed.

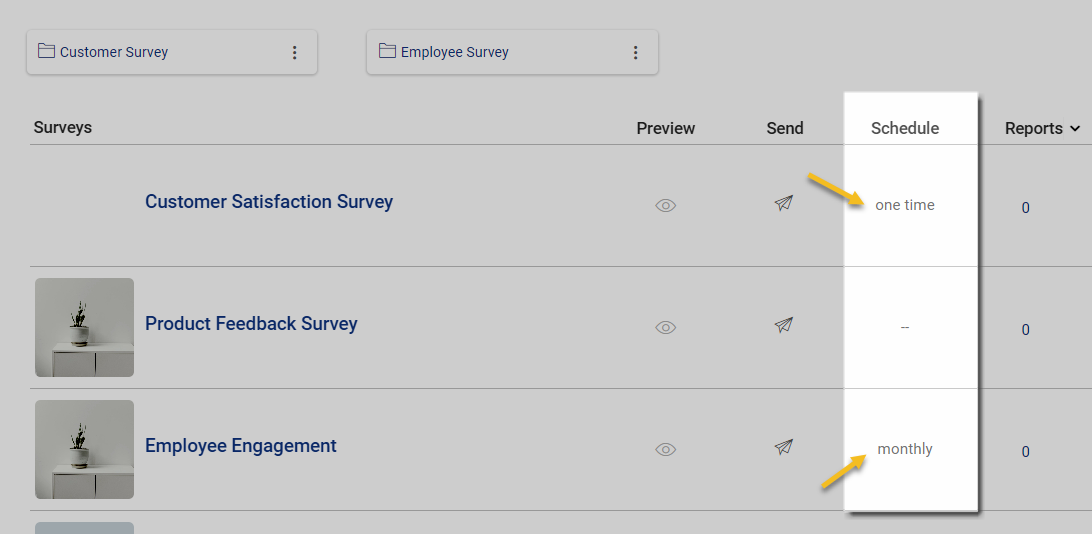

4. You Can Automate the Whole Thing

Set it and forget it (mostly). Create the flow once, and surveys go out like clockwork—right after key touchpoints—without a team member having to lift a finger.

5. People Answer on Their Own Time

Unlike live chats or calls, email surveys give users breathing room. They can reply during a coffee break, on the train, or later that night, which leads to more thoughtful feedback.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

The Usual Pitfalls (& How I’ve Learned to Dodge Them)

Most teams don’t lose customers because of one big mistake — it’s usually a handful of small ones that go unnoticed. Here are the common traps I’ve seen (and sometimes fallen into) — and how to sidestep them:

1. Low Response Rates (Typical: 10–25%)

Let’s be honest—most people ignore surveys. It’s not personal and they’re just busy.

Fix it:

- Keep it to 2–3 questions max

- Personalize the subject line (“Quick question, Alex…”)

- Time it right—ideally within 15 minutes of the action you’re asking about

2. Survey Fatigue

If you hit people with a survey after every little thing, they’ll tune out—or worse, unsubscribe.

Fix it:

- Be intentional—survey key moments, not every moment

- Rotate your audiences (don’t survey your power users every week)

- Set frequency caps if your system allows it

3. Spam & Deliverability Issues

If your emails never hit the inbox, you’re not even in the game.

Fix it:

- Add proper branding to your surveys

- Avoid spammy words in subject lines

- Keep your list clean—remove inactive or bounced addresses regularly

4. Mid-Survey Drop-Offs

You got them to click… and then lost them halfway.

Fix it:

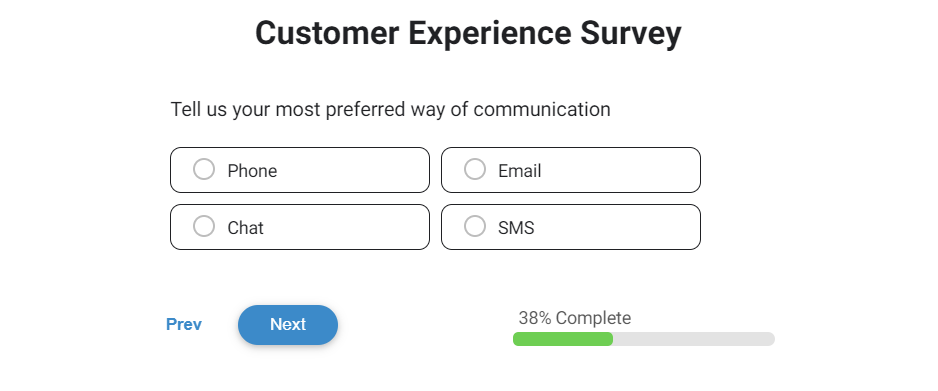

- Show a progress bar (makes a big difference)

- Keep it mobile-friendly—half your opens will be on phones

- Use logic jumps to hide irrelevant questions

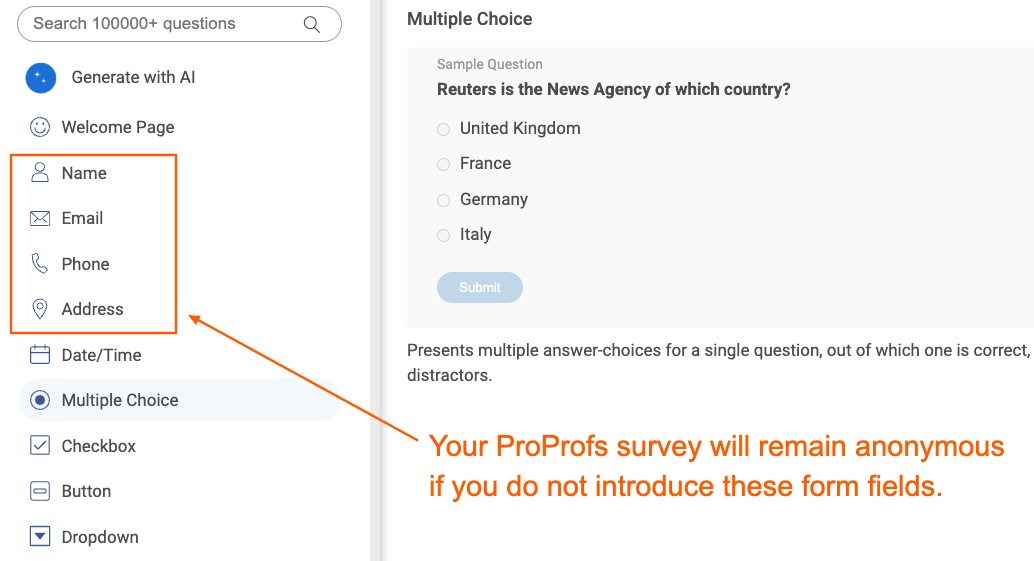

5. Anonymity Concerns

Sometimes people don’t answer honestly because they think you’re watching.

Fix it:

- Make anonymity optional and clearly state it

- Don’t collect IPs or timestamps if you don’t need them

- Use a third-party tool if trust is a blocker

6. Response Bias from a Bad List

If you’re only surveying your happiest customers, your data’s skewed before it even starts.

Fix it:

- Mix in newer users, churned customers, and folks who haven’t engaged in a while

- Use segments based on behavior, not just your email marketing lists

- Aim for diversity in responses, not just volume

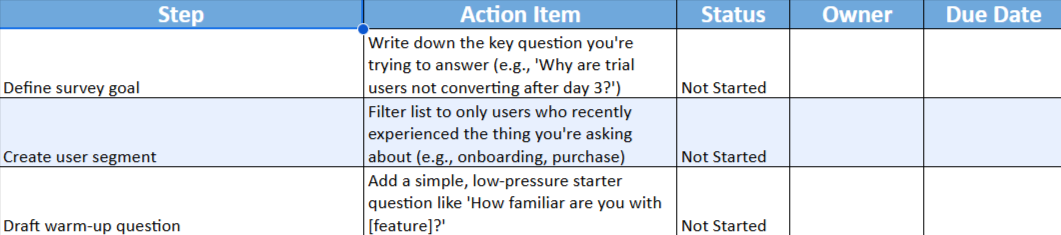

A 6-Step Checklist Before You Create & Send Your Surveys

There’s more to good surveys than timing and deliverability. These are the less obvious but high-impact moves that make sure your email survey doesn’t just land—but gets answered with intent.

1. Write down one question you’re trying to answer before building anything

Not “we need feedback”—literally type: “Why are trial users not converting after day 3?” That becomes your north star.

2. Filter your list to only people who just experienced what you’re asking about

If you’re surveying about onboarding, pull users who signed up in the last 7–10 days. Not last month. Not last year.

3. Start with a warm-up question to ease them in

Before diving into ratings or open text, ask something low-friction first, like “How familiar are you with [feature]?”

4. Replace any product jargon with plain language a new user would understand

Say “our knowledge base” instead of “KB,” “this feature” instead of “BX Request Flow.” Use the words your users actually say.

5. Set expectations about what you’ll do with the feedback

Even something simple like “We use this to improve future sessions” shows respect and builds trust

6. Actually act on the results, and close the loop

Internally, this might mean sharing a “what we heard” slide. With customers or guests, it might be an email summarizing insights. Even a short follow-up makes a big difference.

Make a copy of this Google Sheets Email Survey Checklist and leverage it for the most ultimate surveys.

The Tools I’d Actually Use (And Why)

When you’re picking a survey tool, it’s not about finding “the best”—it’s about finding the right one for your goals, stack, and growth stage.

Here’s how I usually break it down when helping teams choose:

| Tool | Best For | Works Well For... | API | Multilingual | Reporting | Anonymity Control |

|---|---|---|---|---|---|---|

| ProProfs Survey Maker | All-around feedback + automation & internal use | Customer feedback, employee surveys, training, onboarding, eNPS, market research | ✅ | ✅ | ✅ | ✅ (anonymous mode) |

| Qualaroo | In-app and on-site micro surveys | Product feature feedback, onboarding experience, exit intent, NPS | ✅ | ✅ | ✅ | ✅ (anonymous by default) |

| Google Forms | Free & simple internal/external surveys | Quick employee check-ins, event RSVPs, feedback collection on a budget | ❌ | Workarounds | Basic (via Sheets) | Partial |

| SurveyMonkey | Large-scale customer & research surveys | Market research, NPS programs, HR surveys in enterprise settings | ✅ | ✅ | Strong | Partial (settings dependent) |

| Typeform | Engaging, well-designed forms for branding | Customer-facing surveys, application forms, consumer feedback | API (paid) | ✅ | Moderate | Partial (needs setup) |

| Jotform | Highly customizable form-based workflows | Industry-specific surveys in healthcare, banking, etc.; also good for internal forms | ✅ | ✅ | ✅ | Partial (toggle IP tracking) |

Quick Thoughts From Experience:

- Use ProProfs if you want one tool to cover customer, employee, and team workflows. It scales without needing dev help.

- Use Qualaroo if you want in-app feedback right as users are clicking around. Great for product folks.

- Use Google Forms when speed and cost matter more than features.

- Use SurveyMonkey if you’re doing research at scale or need enterprise controls.

- Use Typeform when branding and visual experience are part of the product.

- Use Jotform when your survey needs to look and feel like a custom-built experience.

Launch Email Surveys That Actually Get Responses

Email surveys aren’t outdated—they’re just misunderstood. When used intentionally, they’re one of the most versatile tools you’ve got. They work for customers, employees, webinar attendees, internal teams, and anyone who has just had an experience and has something worth sharing.

The real unlock is not just sending surveys—it’s sending them well:

- At the right moment, not randomly.

- With clear, human questions, not forms that feel like homework.

- In a way that respects their time and actually leads to action.

That’s precisely why I’ve stuck with ProProfs Survey Maker. It’s fast, flexible, and helps me launch email surveys without dragging in dev time or dealing with clunky systems.

So don’t overthink it. Pick one moment. One audience. One goal. Build it. Send it. Learn from it.

The feedback is there—you just need a system to catch it.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

FAQs About Email Surveys

Q: What are 5 good survey questions?

- How satisfied are you with your experience today?

- What’s one thing we could improve?

- How likely are you to recommend us to a friend or colleague?

- Did [feature/service] meet your expectations?

- Was anything unclear or difficult during the process?

Q: Can I trigger email surveys automatically from my CRM system?

Yes, tools like ProProfs Survey Maker let you trigger surveys based on actions in your CRM—like purchases, support resolutions, or cancellations.

Q: How can I ensure anonymity in email surveys?

Use tools that offer anonymous mode, avoid collecting personal identifiers like IP addresses, and clearly communicate that responses are anonymous.

Q: Can I filter email survey results by department or role?

Yes, many platforms let you tag responses or include a department field, and then filter reports accordingly for deeper insights.

Q: How do I prevent my survey emails from going to spam?

Authenticate your sender domain (SPF, DKIM, DMARC), avoid spammy language, and keep your list clean by removing inactive contacts.

Q: How do email surveys compare to in-app, SMS, or website pop-up surveys?

Email surveys offer more space, flexibility, and context. In-app and SMS surveys have higher response rates but are better for single-question, quick feedback.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

We'd love your feedback!

We'd love your feedback!

Thanks for your feedback!

Thanks for your feedback!